4 Things You Must Include in Your Budget

Before or when consulting with an advisor, it's crucial to have a firm grasp of your budget.

When new clients approach us, we invite them to fill out a form that will help us understand their financial situation. This form gathers information about their assets and liabilities, and budgeting practices.

Are our clients budgeting experts? Some of them have been tracking their income and expenses for years, but often the skill of budgeting isn’t a very popular one to practise. That’s why we’ve broken it down into some essentials. These are the most critical elements to include in your budget.

Understanding how to budget effectively and navigate financial crises without everything falling apart are key to whether or not you are able to make financial progress. The key to mastering this lies in the four essential components of a budget. It’s helpful to calculate how much percentage of your budget each element uses, so you can check if your budget is well-distributed and balanced.

1. Food

Food is undoubtedly the first essential you must prioritise in your budget, just like the bottom level of Maslow's hierarchy of needs. By "food," we mean groceries, such as those purchased from Woolies and your local weekend market, not your preferred degustation restaurant.

Takeaways and dining out are NOT essential expenses, as they can become costly when accumulated over time. Based on my personal experience of ordering takeouts for the past month without a proper budget, I discovered that I spend more on takeouts than on my utilities. By gradually transitioning to meal prepping and cooking at home, I can enjoy my favourite meals at a fraction of the price!

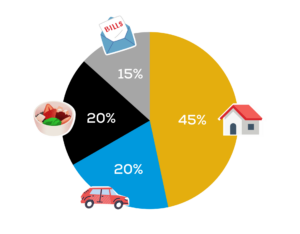

Percentage: Food should take around 10-15% of your budget.

2. Housing

Housing or shelter is one of the four most basic needs that should be factored into a budget. It is important for both physiological needs, such as rest, and security and safety needs. Rent and mortgage is the primary cost in shelter however they can occupy up to half the portions of your budget. In the worst-case scenario, you could potentially move to a lower-cost shelter (cheaper rental), but it is very important to include this as one of the four things to include in a budget.

There can be several elements included under the ‘housing’ title, but primarily we're using it to define your rent or mortgage payments and potentially maintenance costs. We are excluding additional costs like utilities or insurance in this case.

Percentage: Ideally, housing should take around 25-30% of your budget.

3. Utilities

Another significant item to include is your utilities. These are electricity, water, gas, phone bills, or any other essentials that you need to pay to maintain a healthy and habitable living space. According to data from Finder, the average annual power bill ranges from $1,016 up to $1,448. These costs can vary significantly depending on several factors, including:

- your location

- the household size

- the energy efficiency of your appliances

- the service providers

The season may also affect your utility expenses. You’re likely to incur higher electricity costs during summer or winter if you make use of air conditioning or heating. Remember to budget on the higher side of these expenses, especially during the hottest and coldest months, to ensure you are budgeting for these fluctuations.

Percentage: Utilities should take around 5-10% of your budget.

4. Transportation

Transportation is an essential expense that must be accounted for in your budget. The cost of how you get around can vary depending on your lifestyle and location. Whether you drive a car, take public transportation, or rely on other means of getting around, it's important to track your transportation expenses so that you can make informed decisions about your budget.

Here are some of the factors that can affect your transportation expenses:

- Fuel costs: If you drive a car, fuel costs will be a major factor. The cost of fuel can fluctuate regularly so budget a little extra.

- Public transportation: If you take public transportation, your top-up cost should be about the same each month. However, remember that, from time to time, disruptions might mean you choose an unplanned Uber trip to get to work on time.

- Car registration and insurance: Car registration and insurance are fixed costs that you will need to pay regardless of how much you drive. These annual costs can be broken down into weekly or monthly budgeting and saved throughout the year.

- Parking fees and tolls: Parking fees and tolls are likely consistent especially if you have the same routine daily.

If you are fortunate enough to walk to work or most places, you may not have to worry about transportation expenses. Add those funds into your emergency fund or put it towards another significant segment of your budget, such as insurance.

Percentage: Transport should take around 10-15% of your budget.

—-------------------------------------

While these are the things you MUST include in your budget, there are quite a few more elements to consider, including insurances, recreation and savings.

After covering the essentials, gradually incorporate additional budget categories for protection, such as insurance or private health coverage. Consider your personal and entertainment expenses, such as dining out with friends, enjoying a hobby, joining a gym or hiring a personal trainer.

Budgeting doesn’t have to be an unpleasant experience. We suggest finding an app that you enjoy using to help track your expenses in an enjoyable and rewarding way.